What is happening to house prices?

House prices may have been slowing down, but asking prices are on the rise. We look at the latest on what is happening to house prices as ONS releases its latest annual data

If you've been keeping a keen eye on house prices lately like we have been on MoneyWeek, you may have been left wondering what is actually happening with house prices in the UK or indeed if it is a good time to buy a house?

While one index reports a slowdown in house prices, another may suggest a rise - and if you’re reading into what asking prices are, then you will have seen Rightmove saying asking prices went up last month by £3,000 and recent HMRC data shows property transactions were down.

We look at what the latest is with UK house prices as the Office for National Statistics (ONS) today releases its latest data on where house prices are heading.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

ONS: house prices increase 6.3% over 12 months

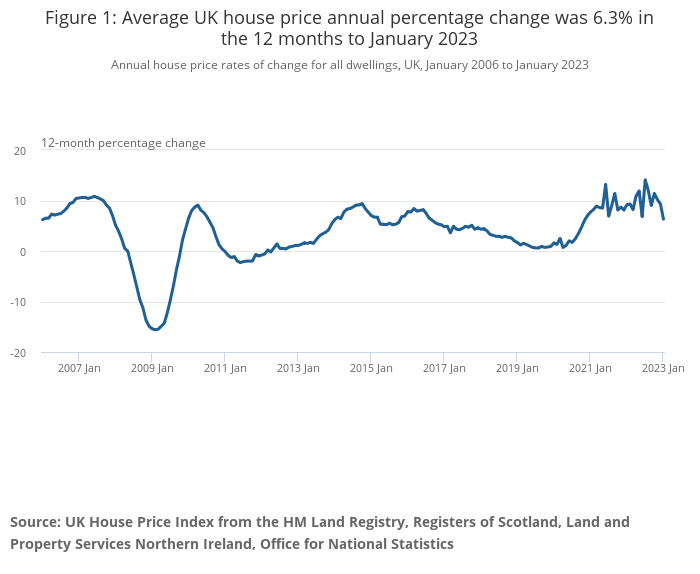

According to today’s ONS data, the average UK house prices increased by 6.3% in the 12 months to January 2023, down from 9.3% in December 2022.

So, while we are seeing a slowdown, prices have increased in a 12 month period.

The average UK house price was £290,000 in January 2023 - £17,000 higher than 12 months ago.

Average house prices increased over the 12 months to £310,000 (6.9%) in England, £217,000 in Wales (5.8%), £185,000 in Scotland (1.0%) and £175,000 in Northern Ireland (10.2%).

And if you’re looking to buy a house in London, you may find the average price tag at around £534,000, though ONS data shows that the rise was up just 3.2% in a year in the capital.

Here's How house prices have been moving since 2006.

Source: ONS

What will happen to house prices in 2023?

The ONS data does not paint a clear picture of what will happen to house prices in 2023. The last 12 months saw extreme turbulence, such as the disastrous mini-Budget headed by then chancellor Kwasi Kwarteng which saw a spike in borrowing costs. Both buyer and seller confidence has been dented, especially as borrowing rates remain high compared to 12 months ago.

According to Tom Bill, head of UK residential research at Knight Frank: “Annual price falls are almost inevitable in the coming months but demand and supply have recovered strongly since Christmas, which means a double-digit price crash this year feels unlikely.”

Sarah Coles, head of personal finance, Hargreaves Lansdown, adds: “Affordability calculations reveal just why rising rates have taken such a toll on buyer confidence. With the average full-time employee in England spending 8.3 times their annual income in order to buy a typical home, we’re being forced to take on ever-larger mortgages. It means a small change in mortgage rates has a far larger impact on our monthly payments.

“On the positive side, from October onwards, mortgage rates started to drop back, and while there were no sudden movements, there’s the hope that as they kept falling, confidence will have started to rebuild a little. We’ve seen a bit more volatility recently, but rates are still expected to trend downwards through the rest of the year as inflation eventually drops back.”

However, it doesn’t alter overall predictions that annual house price inflation will turn negative; the Office for Budget Responsibility expects them to drop 10% from the peak.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

-

Investment trust discounts hit 2008 levels. Here’s how to profit

Investment trust discounts hit 2008 levels. Here’s how to profitInvestment trust discounts have risen to levels not seen since 2008, here are three trusts looking to buy to profit.

By Rupert Hargreaves Published

-

A luxury stock to buy at a high street price

A luxury stock to buy at a high street priceInvestors wrongly consider Watches of Switzerland a high-street outlet.

By Dr Matthew Partridge Published

-

Investing in wine: how Cru Wine is reaching new audiences

Investing in wine: how Cru Wine is reaching new audiencesTips Gregory Swartberg, founder of fine wine specialist Cru Wine, talks to Chris Carter about how to start a wine collection

By Chris Carter Published

-

Small companies with big potential

Small companies with big potentialMichael Taylor of Shifting Shares reviews his 2023 picks and highlights more promising minnows.

By Michael Taylor Published

-

The MoneyWeek portfolio of investment trusts – July 2023 update

The MoneyWeek portfolio of investment trusts – July 2023 updateTips A decade ago we set up the MoneyWeek portfolio of investment trusts. They remain a compelling long-term bet says Rupert Hargreaves

By Rupert Hargreaves Published

-

Women lead the way with ethical investments

Women lead the way with ethical investmentsDemand for more ethical investments has soared – and women are more likely to opt for them. Annabelle Williams, personal finance specialist at Nutmeg, takes a look at why.

By Annabelle Williams Published

-

BoE: Mortgage payments to rise by £220 a month for households

BoE: Mortgage payments to rise by £220 a month for householdsMillions of households can expect a mortgage spike of around £200 a month - and some may even reach a extra £1,000 a month, the Bank of England warns

By Marc Shoffman Published

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

By Simon Wilson Last updated

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

By Nicole García Mérida Published

-

How investors can profit from high food prices

How investors can profit from high food pricesThe latest furore over grocery prices will die down, says David Stevenson. But the long-term outlook for soft commodities remains bullish. These are the stocks investors can buy to profit from high food prices.

By David J Stevenson Published