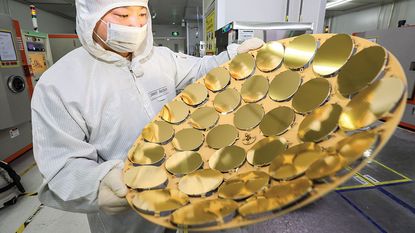

Semiconductor shortage: industry heads for “supersize bust”

The semiconductor shortage could soon become a semiconductor glut as demand for electronic gadgets falls while state subsidies could mean a surplus of supply.

“Chipmakers are the coalface of the modern economy,” says Cormac Mullen on Bloomberg. Demand for semiconductors is a good “leading indicator” for stockmarkets and the economy.

The industry is heading for a slump, say Debby Wu, Jeran Wittenstein and Ian King, also on Bloomberg. The global shortage of chips that started during the pandemic is not over yet – average wait times were 27 weeks in June, up from less than 15 weeks pre-pandemic – but the cycle has clearly started to turn.

The PHLX Semiconductor index, which tracks the industry’s leading lights, gained 43% in 2021, but has fallen 24% since the start of this year. “Disastrous” second-quarter results from Intel and a revenue warning from graphics-card specialist Nvidia show a market that is “rapidly weakening”, says Dan Gallagher in The Wall Street Journal.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Demand for PCs and smartphones has dropped this year: many consumers bought new gadgets during lockdown and don’t feel the need to upgrade. But more worrying is a warning from memory-chip business Micron that demand from big names in the cloud-computing and car industries is also starting to weaken.

Huge state subsidies in the US, Europe and Asia are likely to push the chip industry into long-term overcapacity, says The Economist. Last year’s shortages have convinced leaders that chipmaking is too important to be done overseas in unfriendly countries.

Not that the industry needed government help to overbuild: Intel, Samsung and Taiwanese giant TSMC jointly “invested $92bn…last year”. Some 58 new “fabs” – as semiconductor plants are called – “are scheduled to open between 2022 and 2024”, raising global capacity by about 40%. When that supply comes online, the chipmakers could be heading for “a supersize bust”.

Alex is a member of the UK team at CVC Capital Partners. Prior to joining CVC, Alex worked in the London office of AEA Investors, a mid-market private equity firm. Previously he was part of the UK M&A team at Barclays Capital. Alex holds a BSc in economics from the University of Warwick.

-

-

NS&I August Premium Bonds draw - check from today

NS&I August Premium Bonds draw - check from todayNS&I bond investors can check from today to see if they scooped a prize in this month’s draw. With more than £404m to be handed out in prizes, find out what you won.

By Tom Higgins Published

-

Premium Bond alternatives to turn savings into winnings

Premium Bond alternatives to turn savings into winningsStill waiting on Agent Million to knock on your door? Consider these Premium Bond alternatives for your portfolio.

By Tom Higgins Published

-

UK wage growth hits a record high

UK wage growth hits a record highStubborn inflation fuels wage growth, hitting a 20-year record high. But unemployment jumps

By Vaishali Varu Published

-

UK inflation remains at 8.7% ‒ what it means for your money

UK inflation remains at 8.7% ‒ what it means for your moneyInflation was unmoved at 8.7% in the 12 months to May. What does this ‘sticky’ rate of inflation mean for your money?

By John Fitzsimons Published

-

VICE bankruptcy: how did it happen?

VICE bankruptcy: how did it happen?Was the VICE bankruptcy inevitable? We look into how the once multibillion-dollar came crashing down.

By Jane Lewis Published

-

Would a food price cap actually work?

Would a food price cap actually work?Analysis The government is discussing plans to cap the prices of essentials. But could this intervention do more harm than good?

By Nicole García Mérida Published

-

What is Warren Buffett’s net wealth?

What is Warren Buffett’s net wealth?Features Warren Buffett is one of the world’s richest people. But how did he make his money?

By Jacob Wolinsky Last updated

-

What is Rihanna's net worth?

What is Rihanna's net worth?Features Rihanna became the youngest self-made billionaire in 2022. Here’s how she made her money.

By Jacob Wolinsky Published

-

UK inflation slides to 8.7% - what does it mean for your money?

UK inflation slides to 8.7% - what does it mean for your money?News Inflation has dropped below 10% for the first time in months, but with food prices at a 45-year high, is this good news and what does it mean for your money?

By Tom Higgins Published

-

What is Bill Gates's net worth?

What is Bill Gates's net worth?Features Bill Gates is one of the world’s richest people, but how did he make his money?

By Jacob Wolinsky Last updated