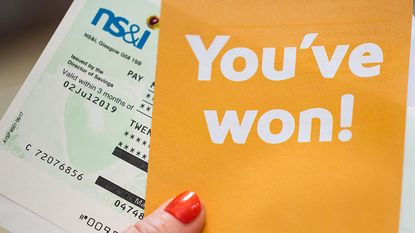

NS&I bumps up interest rate on Premium Bonds again

NS&I is increasing the Premium Bond prize rate for the second time this year, meaning there are hundreds of extra prizes in every draw. We look at how the changes will affect you.

National Savings & Investments has bumped up the interest rate on Premium Bonds again at the same time when rate increases on some of its other products also kicked in. If you’re on the lookout for the best savings accounts for your cash, then could NS&I be worth another look?

The Premium Bonds prize fund rate will jump from 3% to 3.15% (effective from the February 2023 prize draw), representing another increase after the rate went up from 2.2% to 3% on 1 January 2023.

Other product rate increases include:

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

- Direct Saver - up 2.3% to 2.6%

- Income Bonds - up 2.3% to 2.6%

- Direct ISA - up from 1.75% tax-free to 2.15% tax-free

- Junior ISAs - up from 2.70% tax-free to 3.40% tax-free

More than 870,000 customers holding NS&I’s Direct Saver, Income Bonds and Direct ISA will benefit from the increased rates, plus 80,000 junior ISA account holders.

The new rate on income bonds at 2.6% is the highest NS&I is paying since 2008, and 2.15% on the direct ISA product is the highest seen in a decade. And the latest rate rise on the direct saver product at 2.6% is not the highest since it launched in March 2010.

Premium bonds rate rise - now at highest level in 14 years

The rate rise on premium bonds is the fourth increase NS&I has made in the last 12 months in a bid to lure savers into the government backed bank.

If you have premium bonds the rate actually means the number of prizes, worth between £50,000 and £100,000, will increase - so there’s a higher chance of you bagging a larger amount of prize money from February 2023.

NS&I chief executive, Ian Ackerley, said: “Today’s changes will provide a welcome boost for savers of all ages across the country, with more Premium Bonds prizes and some of the highest interest rates we’ve seen in over a decade.

“In a fast changing savings market, we’re committed to making sure our products remain competitive and our customers get a good return on their savings. Today’s changes ensure that we continue to balance the needs of savers, taxpayers and the broader financial services sector.”

However, despite the increases it is worth noting that the rates are not necessarily market leading and it will pay to shop around, as banks and building society rates on savings products have been creeping up in recent weeks; and with the Bank of England expected to increase interest rates again next month, better rates may well be on the horizon.

It's also worth noting that none of these rates are market-leading. For non-ISA savings you can make 2.9% elsewhere from the first £1, without any restrictions, and even for ISA savings you can make 2.75% on the same basis. And you could get 3.8% on cash junior ISAs from Coventry Building Society.

“This is effectively NS&I playing catch up after the easy access market has crept up with successive interest rate rises,” Sarah Coles, head of personal finance at Hargreaves Lansdown commented.

What are the chances of winning per bond?

According to NS&I, this is the estimated number of prizes we can expect to see next month.

Number and value of Premium Bonds prizes

| Value of prizes in January 2023 | Number of prizes in January 2023 | Value of prizes in February 2023 (estimated) | Number of prizes in February 2023 (estimated) |

| £1,000,000 | 2 | £1,000,000 | 2 |

| £100,000 | 56 | £100,000 | 59 |

| £50,000 | 111 | £50,000 | 117 |

| £25,000 | 224 | £25,000 | 236 |

| £10,000 | 559 | £10,000 | 590 |

| £5,000 | 1,116 | £5,000 | 1,177 |

| £1,000 | 11,968 | £1,000 | 12,573 |

| £500 | 35,904 | £500 | 37,719 |

| £100 | 1,159,432 | £100 | 1,280,509 |

| £50 | 1,159,432 | £50 | 1,280,509 |

| £25 | 2,617,902 | £25 | 2,376,161 |

| Total: £299,202,350 | Total: £4,986,706 | Total: £314,347,875 | Total: £4,989,652 |

Source: NS&I

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

-

Investment trust discounts hit 2008 levels. Here’s how to profit

Investment trust discounts hit 2008 levels. Here’s how to profitInvestment trust discounts have risen to levels not seen since 2008, here are three trusts looking to buy to profit.

By Rupert Hargreaves Published

-

A luxury stock to buy at a high street price

A luxury stock to buy at a high street priceInvestors wrongly consider Watches of Switzerland a high-street outlet.

By Dr Matthew Partridge Published

-

August NS&I Premium Bond winners unveiled - have you scooped £1m?

August NS&I Premium Bond winners unveiled - have you scooped £1m?Two lucky NS&I Premium Bond winners are now millionaires in the August draw. Find out here if you are one of them

By Tom Higgins Published

-

Savings rates more than double in a year as challenger banks top the best buy tables

Savings rates more than double in a year as challenger banks top the best buy tablesThe best savings rates have doubled - and in some cases tripled - in a year, with challenger banks offering the highest rates. While they are still no match for inflation, we look at what you could be earning.

By Ruth Emery Published

-

Midlife MOT: what is it and who can get one?

Midlife MOT: what is it and who can get one?The government has launched an online midlife MOT to help older workers with financial planning, health guidance and career skills. But how does it work, who can get one and would you pass it?

By Ruth Emery Published

-

Coventry Building Society launches new best easy access savings account

Coventry Building Society launches new best easy access savings accountCoventry Building Society's deal tops our easy access savings account list, but could your cash be put to better use?

By Tom Higgins Published

-

NS&I boosts fixed-term savings rates

NS&I boosts fixed-term savings ratesThe NS&I, the government-backed savings institution has mirrored recent rate rises seen elsewhere in the market.

By Tom Higgins Published

-

Should you let AI give you financial advice?

Should you let AI give you financial advice?Can AI fill the financial advice gap? Kalpana Fitzpatrick looks at the pros and cons of using AI to guide your finances.

By Kalpana Fitzpatrick Published

-

Small pension pots to be consolidated, says DWP

Small pension pots to be consolidated, says DWPWorkplace pension schemes worth less than £1,000 that become “deferred” when a saver changes jobs will be consolidated under a new system

By Ruth Emery Published

-

Watchdog summons banks to explain paltry savings rates

Watchdog summons banks to explain paltry savings ratesSavings rates trail mortgage rates - and the financial watchdog has summoned banks to a meeting amid concerns of profiteering.

By Katie Binns Last updated