House prices rise 4.1% in last year - but fall monthly for fourth consecutive time

The latest house price index show finds that house prices are slowing

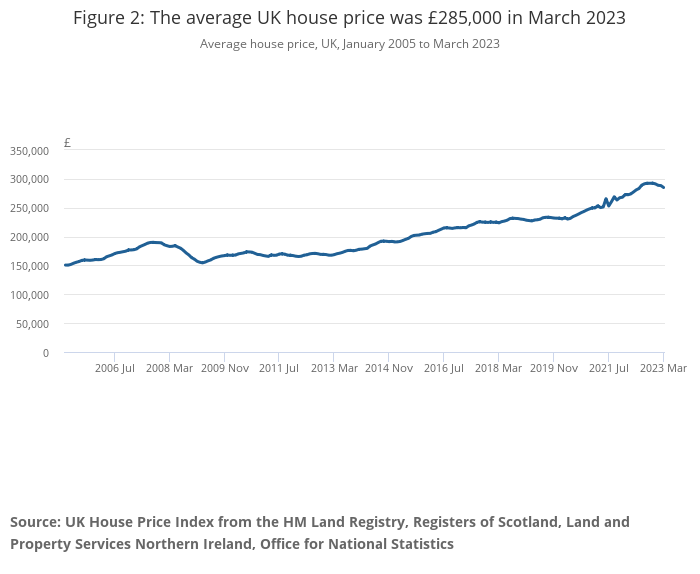

The value of the average property in the UK rose 4.1% in the 12 months to March 2023, adding £11,000 to a typical home, according to the latest ONS house price index.

But on a monthly basis, property prices have fallen for the fourth consecutive time, decreasing 1.2% in March 2023, following a fall of 0.1% in February 2023. This could be further indication that house prices could finally come down further in 2023.

It means that the average value of a UK property now stands at £285,000. That’s down from a recent peak of £293,369 in November 2022.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Where are house prices rising the fastest?

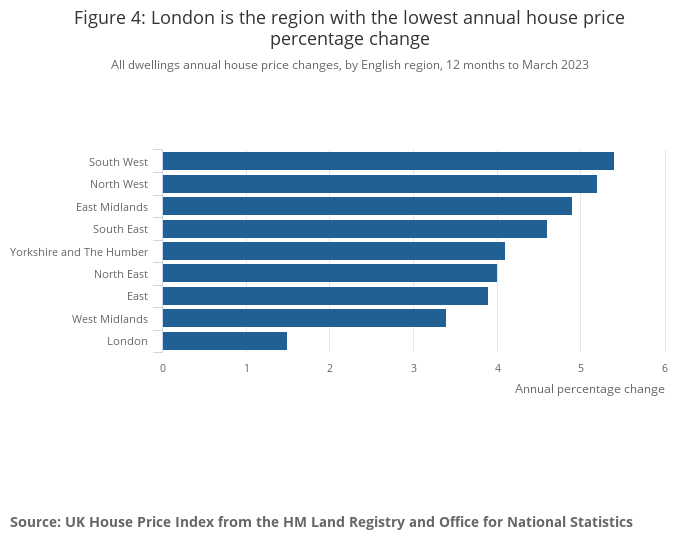

There are regional differences too: The average price in England was £304,000, up 4.1%, while in Wales it was £214,000 and up 4.8%. Meanwhile, prices rose 3% to £185,000 in Scotland and 5% to £172,000 in Northern Ireland.

In England, the highest annual increase was in the South West, up 5.4%, while London’s house prices only rose 1.5%.

The annual price increase is a considerable slowdown from July last year when the cost of a property had soared 14.4% in just 12 months.

The ONS said that there had been some 89,560 residential house purchases last month, nearly 19% lower than a year earlier, but up slightly by 1.3% from February.

“Rising interest rates and economic pressures have not stood in the way of many buyers or sellers’ ambitions as the housing market shows strong resilience and house prices rise in March,” said Emma Cox, managing director of real estate at Shawbrook Bank.

“And while buyers are likely to remain relatively cautious moving forward, as mortgage rates remain high in line with rising interest rates, it’s encouraging to see these signs of optimism back in the market.

“The well-documented lack of supply within the rental market could prompt professional landlords to snap up properties and expand their rental portfolios before any further price rises.

“This should help to provide an injection of quality stock, with demand currently being starved of good, available properties for renters.”

Katie Binns is an award-winning journalist, and former Sunday Times writer where she spent 10 years covering news, culture, travel, personal finance and celebrity interviews. She has also written for the Times, Telegraph, i paper and Woman and Home magazine.

Her investigative work on financial abuse has examined the response of banks, the Financial Ombudsman and the child maintenance service to victims, and resulted in a number of debt and mortgage prisoners being set free.

-

-

Investment trust discounts hit 2008 levels. Here’s how to profit

Investment trust discounts hit 2008 levels. Here’s how to profitInvestment trust discounts have risen to levels not seen since 2008, here are three trusts looking to buy to profit.

By Rupert Hargreaves Published

-

A luxury stock to buy at a high street price

A luxury stock to buy at a high street priceInvestors wrongly consider Watches of Switzerland a high-street outlet.

By Dr Matthew Partridge Published

-

Investing in wine: how Cru Wine is reaching new audiences

Investing in wine: how Cru Wine is reaching new audiencesTips Gregory Swartberg, founder of fine wine specialist Cru Wine, talks to Chris Carter about how to start a wine collection

By Chris Carter Published

-

Small companies with big potential

Small companies with big potentialMichael Taylor of Shifting Shares reviews his 2023 picks and highlights more promising minnows.

By Michael Taylor Published

-

The MoneyWeek portfolio of investment trusts – July 2023 update

The MoneyWeek portfolio of investment trusts – July 2023 updateTips A decade ago we set up the MoneyWeek portfolio of investment trusts. They remain a compelling long-term bet says Rupert Hargreaves

By Rupert Hargreaves Published

-

Women lead the way with ethical investments

Women lead the way with ethical investmentsDemand for more ethical investments has soared – and women are more likely to opt for them. Annabelle Williams, personal finance specialist at Nutmeg, takes a look at why.

By Annabelle Williams Published

-

BoE: Mortgage payments to rise by £220 a month for households

BoE: Mortgage payments to rise by £220 a month for householdsMillions of households can expect a mortgage spike of around £200 a month - and some may even reach a extra £1,000 a month, the Bank of England warns

By Marc Shoffman Published

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

By Simon Wilson Last updated

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

By Nicole García Mérida Published

-

How investors can profit from high food prices

How investors can profit from high food pricesThe latest furore over grocery prices will die down, says David Stevenson. But the long-term outlook for soft commodities remains bullish. These are the stocks investors can buy to profit from high food prices.

By David J Stevenson Published