Gold has been incredibly boring to own – but that’s no bad thing right now

Stocks, bonds and cryptocurrencies have all seen big falls this year. But gold remains at its one-year average. It may be dull, but it’s doing what it’s supposed to do, says Dominic Frisby. Preserving its value – and your capital.

I haven’t covered the perennial disappointment that is gold for a while, and I felt it is overdue some attention, so that will be the subject of today’s article.

I say perennial disappointment, because it “should” be so much higher. It’s summer. Usually, the best time of year to buy each year is in the June to August timeframe.

I stress “usually”, not always. A summer low in gold is frequent enough to be noticeable, but not consistent enough to be reliable. A bit like your errant teenager’s mood swings.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In terms of price, the high for the year was $2,080 per ounce – in March, shortly after you know who invaded you know where.

The low for the year was $1,780 – that came in January. We also came close to that figure in May ($1,785 was the low).

And today we are meandering around the $1,820 mark, which is also where the 52-week moving average lies.

That’s actually quite a telling little fact. For all the declines we’ve seen elsewhere in stocks, bonds and crypto, and the ensuing erosion of wealth, gold sits at its one-year average. In other words, it’s done what it’s supposed to: preserved its value, and preserved your capital.

And that’s with the US dollar so strong.

Gold has done surprisingly well, particularly if you’re a sterling investor

Gold has actually done rather better against other currencies. The chart below shows gold in dollars (red), but also gold measured in pounds (blue), Japanese yen (green) and euros (yellow).

You can see that against all those three currencies, gold is not far off its all-time highs.

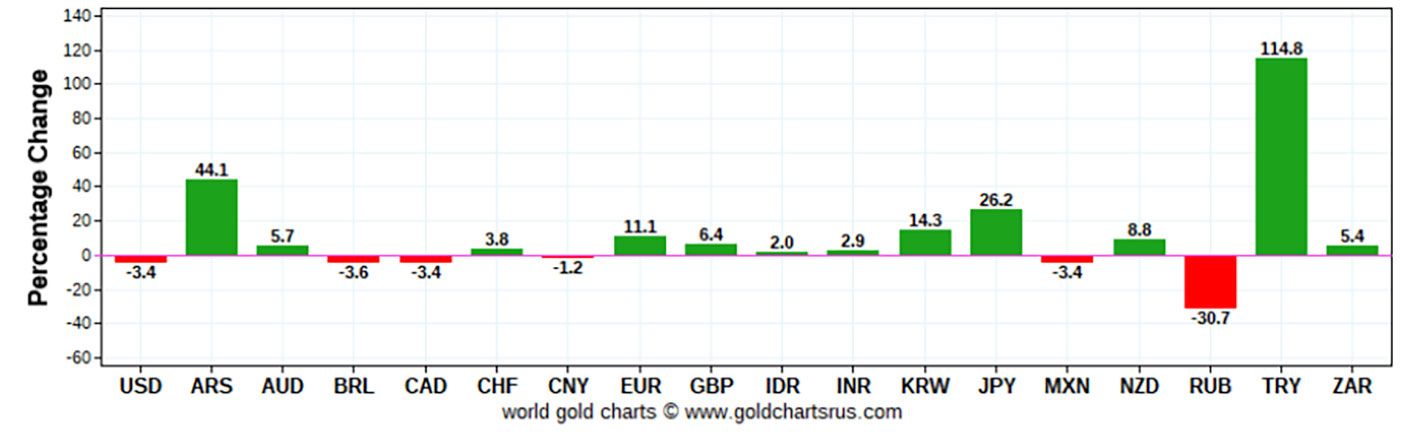

Here’s another way of looking at the same thing. This is gold against 18 national currencies. It’s down a little against some of them – the US and Canadian dollars, the Chinese yuan, the Brazilian real, the Mexican peso and the Russian rouble (how has the rouble been so strong?!).

But it’s up, significantly in some cases, against others – the Argentinian peso, the Swiss franc, the euro, the pound, the Korean won, the Japanese yen and, of course, the Turkish lira.

Gold percentage growth for 2021

Gold’s price is being determined then by the much bigger market that is the US dollar, as much as anything. Where’s the US dollar going next? Your guess is as good as mine.

Monetary policy is tighter there than elsewhere, it’s the first port of call for capital in a panic, and so the dollar keeps rising. Currently at 104 on the index, it could go all the way to 120. Unlikely, but it’s been there before.

If it does, gold almost certainly won’t be going anywhere significant.

But of course, if the dollar heads lower – and it will if other countries start to tighten as much as the US – then gold will make a move. I gather analysts at Goldman Sachs have just put a $2,500 year-end target on gold. That would be nice.

Is gold heading for a repeat of the 1970s?

So many comparisons are being made between today and the 1970s. Politically and economically there are parallels galore. The big differences are technological.

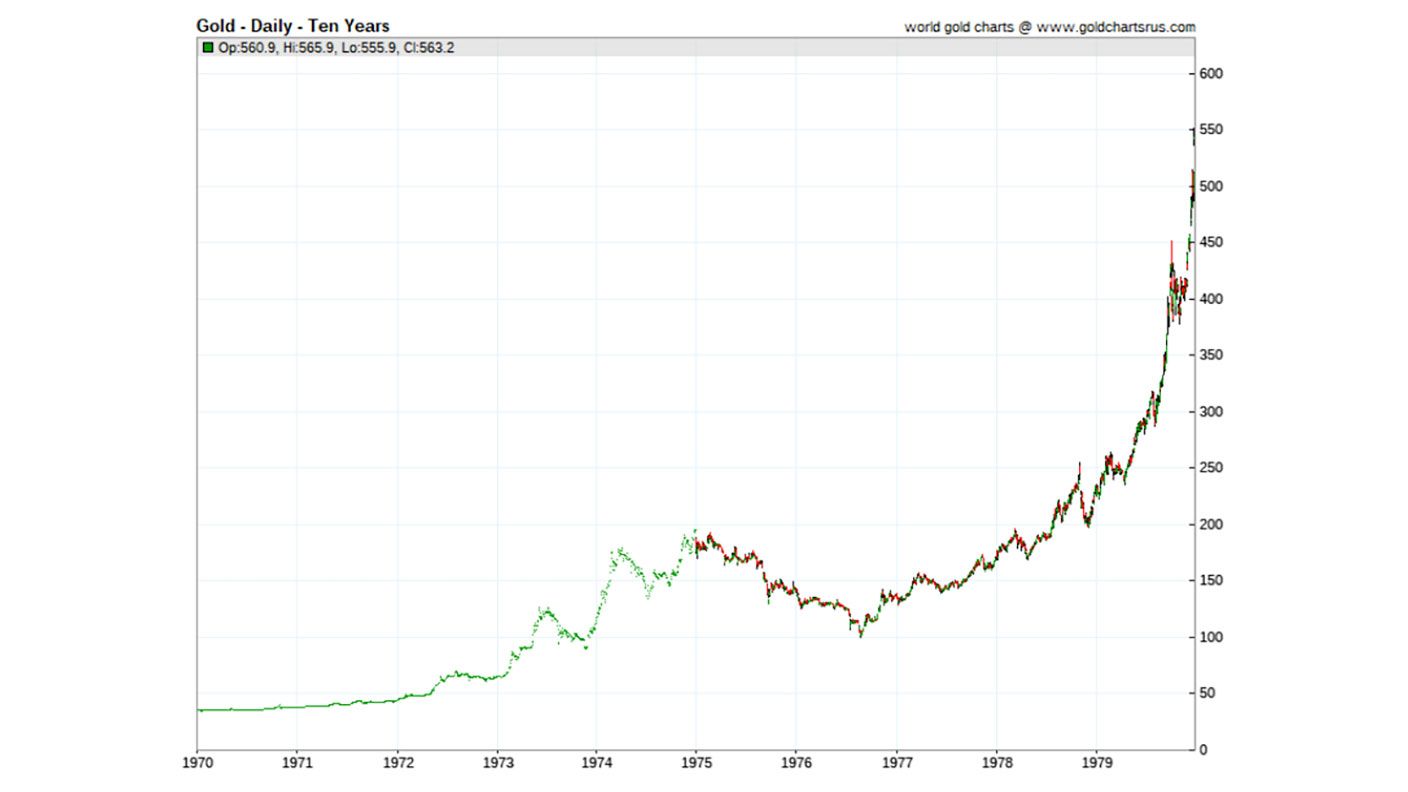

Nevertheless, gold had one of its best ever decades in the 1970s, going from $35/oz in 1971 to $850 (albeit briefly) early in 1980. It was bonanza time for gold mining.

But even within that bonanza decade, gold went through a near two-year bear market in 1975-1976 that saw it fall by nearly half – going from around $200/oz to $100. Imagine if gold went to $1,000 now. That would be hard to swallow.

Here is gold during its glory years.

Longer term, the fundamentals of out-of-control inflation, geopolitical instability, escalating de-globalisation and weak, unpopular leadership all tend to be drivers of flight to gold. But it remains an analogue asset in a world where all the value is digital.

It was me that first made this comparison many years ago, though I still haven’t decided what the answer is. The horse was transport for thousands of years. It was “natural transport”. With the invention of the car it became irrelevant.

Gold, too, was money for thousands of years, “natural money”. But with digital technology and modern communications, is it now as irrelevant to finance and the horse is to transport? Or, like King Arthur to the English, will gold return to finance to save the people in their hour of need?

I guess, until it actually does shows up, we’ll never know the answer

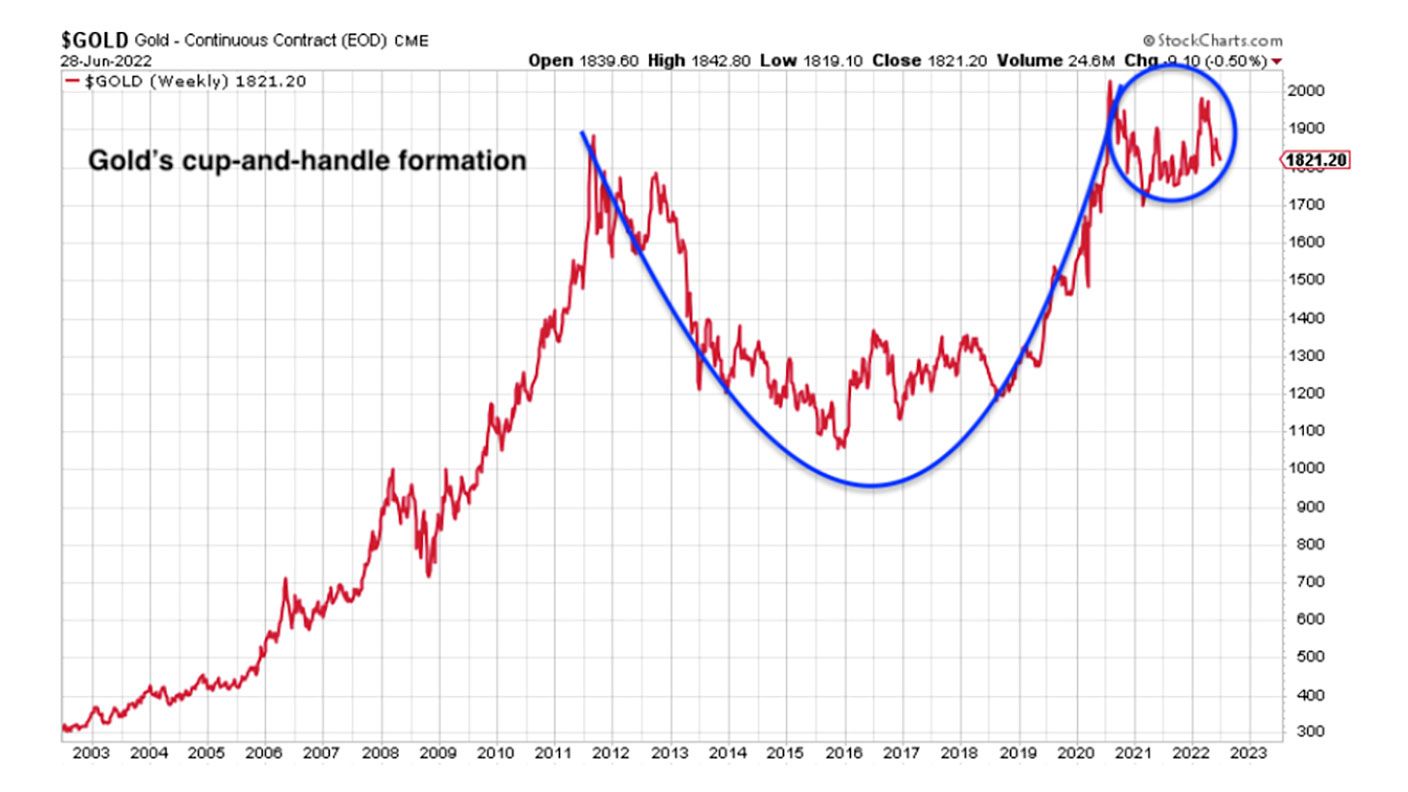

From a technical perspective, that enormous cup-and-handle formation, built up over a decade, remains in play and looks ready to propel gold higher. I’ve illustrated it here.

Cups and handles are another of those commonly observed chart patterns – like “double tops” or “head and shoulders” – which are fairly self-explanatory. This one was first observed in the 1980s. Investopedia calls it a “technical chart pattern that resembles a cup and handle”. It is considered a very bullish signal.

If it plays out, it will give Goldman Sachs their target. And some.

I own gold and I’m glad I do. I may be rude about it, but I love it. And it’s the one part of my portfolio that isn’t keeping me awake at night. In fact, it’s so boring, it’s helping me to sleep.

Dominic will be performing his show, How Heavy?, a lecture with funny bits about the history of weights and measures, at the Edinburgh Fringe this August. You can get tickets here.

Dominic Frisby (“mercurially witty” – the Spectator) is the world’s only financial writer and comedian. He is MoneyWeek’s main commentator on gold, commodities, currencies and cryptocurrencies. He is the author of the books Bitcoin: the Future of Money? and Life After The State. He also co-wrote the documentary Four Horsemen, and presents the chat show, Stuff That Interests Me.

His show 2016 Let’s Talk About Tax was a huge hit at the Edinburgh Festival and Penguin Random House have since commissioned him to write a book on the subject – Daylight Robbery – the past, present and future of tax will be published later this year. His 2018 Edinburgh Festival show, Dominic Frisby's Financial Gameshow, won rave reviews. Dominic was educated at St Paul's School, Manchester University and the Webber-Douglas Academy Of Dramatic Art.

You can follow him on Twitter @dominicfrisby

-

-

Investment trust discounts hit 2008 levels. Here’s how to profit

Investment trust discounts hit 2008 levels. Here’s how to profitInvestment trust discounts have risen to levels not seen since 2008, here are three trusts looking to buy to profit.

By Rupert Hargreaves Published

-

A luxury stock to buy at a high street price

A luxury stock to buy at a high street priceInvestors wrongly consider Watches of Switzerland a high-street outlet.

By Dr Matthew Partridge Published

-

Investing in wine: how Cru Wine is reaching new audiences

Investing in wine: how Cru Wine is reaching new audiencesTips Gregory Swartberg, founder of fine wine specialist Cru Wine, talks to Chris Carter about how to start a wine collection

By Chris Carter Published

-

Small companies with big potential

Small companies with big potentialMichael Taylor of Shifting Shares reviews his 2023 picks and highlights more promising minnows.

By Michael Taylor Published

-

The MoneyWeek portfolio of investment trusts – July 2023 update

The MoneyWeek portfolio of investment trusts – July 2023 updateTips A decade ago we set up the MoneyWeek portfolio of investment trusts. They remain a compelling long-term bet says Rupert Hargreaves

By Rupert Hargreaves Published

-

Women lead the way with ethical investments

Women lead the way with ethical investmentsDemand for more ethical investments has soared – and women are more likely to opt for them. Annabelle Williams, personal finance specialist at Nutmeg, takes a look at why.

By Annabelle Williams Published

-

BoE: Mortgage payments to rise by £220 a month for households

BoE: Mortgage payments to rise by £220 a month for householdsMillions of households can expect a mortgage spike of around £200 a month - and some may even reach a extra £1,000 a month, the Bank of England warns

By Marc Shoffman Published

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

By Simon Wilson Last updated

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

By Nicole García Mérida Published

-

How investors can profit from high food prices

How investors can profit from high food pricesThe latest furore over grocery prices will die down, says David Stevenson. But the long-term outlook for soft commodities remains bullish. These are the stocks investors can buy to profit from high food prices.

By David J Stevenson Published