Are gold miners finally set to outperform plain old gold?

Gold miners are meant to outperform gold. Yet since 2003, that hasn’t been the case. What’s changed – and will they ever make a comeback? Dominic Frisby explains.

“Look at what they do, not at what they say.”

If you are seeking truth of any kind, this is a great maxim to live by - particularly when it comes to politicians. And lovers.

My advice today is to apply the maxim to your author, because there is a marked divergence between what I say on the subject of gold mining companies and what I actually do.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

We’ll start with what I say…

Here’s why everyone believes that gold miners are a leveraged play on gold

Talk to any grizzled goldbug who remembers the 1930s – there must be one or two that were there – and one or two more that have read about them. In the US, the story went as follows.

After the stock market crash of 1929, the US sunk into an economic recession that became known as the Great Depression. In order to fund a government stimulus programme, the President, Franklin D Roosevelt, confiscated his citizens’ gold.

It became illegal for Americans to own gold. Like the loyal citizens they were, Americans handed their gold in and the authorities gave them dollars in exchange at the official exchange rate of $20 per ounce.

Roosevelt then devalued those dollars by 40%. The official price of gold would now be $35 per ounce.

Some moaned, while many didn’t notice, but the cannier folk thought: “We might not be able to own gold, but we can own gold mining companies – and their profit margins have just gone bananas.”

Homestake was the biggest gold miner in North America at the time. Its share price multiplied many times over. It became the investment of the decade.

Fast forward to the 1970s, a decade which policy-makers seem intent on re-living in some kind of Black Mirror parallel universe situation. Inflation was rampant, money was debased, the gold standard was abandoned and there was an energy crisis. The decade ended with Russia invading a neighbouring country, in this case Afghanistan.

Gold went from $35 to (briefly) $850 over the course of the decade. But gold miners – whoosh. They multiplied and multiplied and multiplied. They were the investment of the decade.

Thus has it been implanted in our psyche that gold miners give you leverage to the gold price. When gold goes up, gold miners go up by more.

Except they don’t.

Gold miners have been terrible investments compared to boring old gold

Here we now present Exhibit A, which is the ratio between the HUI, the index of unhedged gold miners, and gold since the mid-1990s.

The chart has been falling since late 2003. In other words, gold has been outperforming gold shares. Apart from odd bouts of outperformance, this has been the case for more than 15 years now.

Barrick, off and on the world’s largest gold mining company, has had a good couple of years since it changed management. Even so, it is still trading at the same price it was in 2005. Gold was selling for less than $500 an ounce in 2005. It’s $1,900 now.

In 2018, Barrick was trading at the same price it was in 2001. In 2001, gold was $250.

In other words, what has been the point of owning gold miners, when you could simply have owned gold? And some would argue what is the point of gold, when you can own bitcoin?

The reason, in my view, aside from a proliferation of incompetence among management, is that, starting in around about 2003, when that chart peaked, we saw a plethora of different ways by which ordinary investors could buy and hold gold.

Aside from taking delivery of bullion itself, we saw the rise of online storage companies – Goldmoney, Bullion Vault, Goldcore and so on. The exchange traded funds (ETFs), by which investors and institutions could buy and hold gold via a broker, came into existence. Cheap online brokers became commonplace. If you wanted something a bit racier, there were spreadbets, futures, CFDs, covered warrants, leveraged ETFs and more.

They made the gold miner’s role as the levered way to play gold even more redundant.

Has that changed? No. It’s very hard to intellectually justify owning a gold miner in the face of the above. So that is what I say.

But what do I do? I own a load of gold miners. I’m overweight gold miners.

I’ve spent a lot of time researching. I think the ones I own are really good – exceptional even. But they are still gold miners – and sector allocation usually proves more important than individual company selection.

I do look at that above ratio and suggest that it has made a low and is now rising. The low came at the end of 2015 and it was re-tested in the coronavirus panic of 2020. It looks like it’s on the rise.

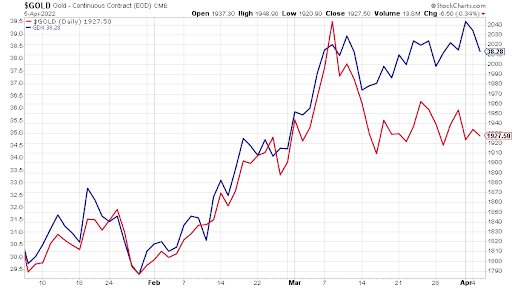

I also note an odd divergence over the last month, as the chart below shows. Gold sold off. Gold miners didn’t. They actually outperformed. What gives?

Gold is in red. The miners are in blue. See the outperformance??

Gold mining companies are better run, generally, than they were. There are some real growth opportunities. But it is still a dirty, risky business and a lot can go wrong.

So what’s the point? I don’t know. But look at what I do, not what I say.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

Dominic Frisby (“mercurially witty” – the Spectator) is the world’s only financial writer and comedian. He is MoneyWeek’s main commentator on gold, commodities, currencies and cryptocurrencies. He is the author of the books Bitcoin: the Future of Money? and Life After The State. He also co-wrote the documentary Four Horsemen, and presents the chat show, Stuff That Interests Me.

His show 2016 Let’s Talk About Tax was a huge hit at the Edinburgh Festival and Penguin Random House have since commissioned him to write a book on the subject – Daylight Robbery – the past, present and future of tax will be published later this year. His 2018 Edinburgh Festival show, Dominic Frisby's Financial Gameshow, won rave reviews. Dominic was educated at St Paul's School, Manchester University and the Webber-Douglas Academy Of Dramatic Art.

You can follow him on Twitter @dominicfrisby

-

-

Investment trust discounts hit 2008 levels. Here’s how to profit

Investment trust discounts hit 2008 levels. Here’s how to profitInvestment trust discounts have risen to levels not seen since 2008, here are three trusts looking to buy to profit.

By Rupert Hargreaves Published

-

A luxury stock to buy at a high street price

A luxury stock to buy at a high street priceInvestors wrongly consider Watches of Switzerland a high-street outlet.

By Dr Matthew Partridge Published

-

Investing in wine: how Cru Wine is reaching new audiences

Investing in wine: how Cru Wine is reaching new audiencesTips Gregory Swartberg, founder of fine wine specialist Cru Wine, talks to Chris Carter about how to start a wine collection

By Chris Carter Published

-

Small companies with big potential

Small companies with big potentialMichael Taylor of Shifting Shares reviews his 2023 picks and highlights more promising minnows.

By Michael Taylor Published

-

The MoneyWeek portfolio of investment trusts – July 2023 update

The MoneyWeek portfolio of investment trusts – July 2023 updateTips A decade ago we set up the MoneyWeek portfolio of investment trusts. They remain a compelling long-term bet says Rupert Hargreaves

By Rupert Hargreaves Published

-

Women lead the way with ethical investments

Women lead the way with ethical investmentsDemand for more ethical investments has soared – and women are more likely to opt for them. Annabelle Williams, personal finance specialist at Nutmeg, takes a look at why.

By Annabelle Williams Published

-

BoE: Mortgage payments to rise by £220 a month for households

BoE: Mortgage payments to rise by £220 a month for householdsMillions of households can expect a mortgage spike of around £200 a month - and some may even reach a extra £1,000 a month, the Bank of England warns

By Marc Shoffman Published

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

By Simon Wilson Last updated

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

By Nicole García Mérida Published

-

How investors can profit from high food prices

How investors can profit from high food pricesThe latest furore over grocery prices will die down, says David Stevenson. But the long-term outlook for soft commodities remains bullish. These are the stocks investors can buy to profit from high food prices.

By David J Stevenson Published