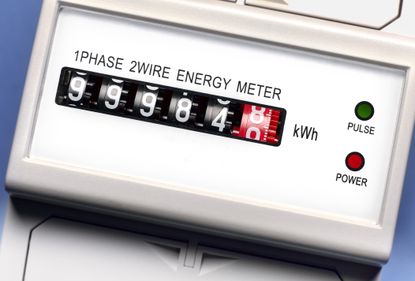

Energy meter reading: submit your reading to avoid getting overcharged

Households are encouraged to take an energy meter reading as soon as possible after the price cap change on Saturday

With the latest energy price cap now in effect, households should look to submit a meter reading as soon as possible if they haven't already to ensure they are billed correctly.

Households were encouraged to submit a reading by midnight on Friday 30 June, and failing that to take a reading early on Saturday 1 July - but there is still time if you have not yet taken yours.

Energy bills fell from Saturday 1 July after Ofgem announced in May that energy costs would fall by around 17%, taking the average typical bill to around £2,074 between July and October.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The energy price cap fell from its previous level of £3,280 and will replace the government’s default energy price guarantee, which limited the average typical household energy bill to around £2,500 a year since 1 October 2022.

Now that Ofgem's energy price cap has fallen below the government’s default rate, households should submit a meter reading to ensure they do not end up paying a higher rate from 1 July.

Why do I need to take a meter reading?

From 1 July, anyone not on a fixed tariff will pay the new rate under the energy price cap.

Taking a meter reading ensures that your next bill reflects the new rate.

An updated meter reading ensures also stops your supplier from determining a bill price that isn’t actually in line with your usage.

If your energy usage is lower than your supplier’s estimate you can ask it to lower your monthly direct debit to a more appropriate amount. Energy companies already owe almost £7bn to 16 million households in customer credit after increasing customers’ direct debits in reaction to energy price rises - that’s overall £5bn higher than last year.

Most customers can submit meter readings by phone or online via their supplier’s website or app. Some suppliers even have online chat or text services.

Gareth Kloet, energy spokesperson for Go.Compare energy, said: “By taking a meter reading on 30 June, before the price drop comes into force, it will mean that your energy company cannot charge you at the higher rate for any units that have been used after that date.

"And in general, it’s worth providing your supplier with regular readings so that they can work out your bills accurately, otherwise they will estimate your usage which means you could be paying more than you need to," he added.

What should I do if my supplier’s website crashes?

Last year ahead of changes on 1 April customers reported issues sending meter readings online to supplier websites including British Gas, EDF, E.On, SSE, So Energy and Octopus Energy - many suppliers’ websites and apps seemed unable to cope with the surge in demand as households scrambled to submit readings on 31 March.

In these cases customers were allowed to submit readings up to 30 days later so that suppliers could backdate the meter reading.

As a back-up, take a photo of your meter reading on your phone – this way you have proof of the date the readings were taken. And you could also email it to yourself – which again gives you a timestamp should you need to raise a complaint with your supplier further down the line.

Who doesn't need to submit a meter reading?

Not every household needs to submit a meter reading before midnight on 30 July.

These households include those who are on a fixed-rate tariff or have a smart meter, which automatically sends readings to your supplier, or a prepayment meter.

Katie Binns is an award-winning journalist, and former Sunday Times writer where she spent 10 years covering news, culture, travel, personal finance and celebrity interviews. She has also written for the Times, Telegraph, i paper and Woman and Home magazine.

Her investigative work on financial abuse has examined the response of banks, the Financial Ombudsman and the child maintenance service to victims, and resulted in a number of debt and mortgage prisoners being set free.

-

-

Top-quality small companies with big scope for long-term growth

Top-quality small companies with big scope for long-term growthA professional investor tells us where he’d put his money. This week: Dr Gareth Blades, analyst at Amati Global Investors, highlights three favourites.

By Nicole García Mérida Published

-

Starling Bank hikes fixed savings rate to 5.25%

Starling Bank hikes fixed savings rate to 5.25%Starling Bank has hiked the rate on its fixed savings which has shot up from 3.25% to 5.25% - but how does it compare to the rest of the market?

By Vaishali Varu Published

-

August NS&I Premium Bond winners unveiled - have you scooped £1m?

August NS&I Premium Bond winners unveiled - have you scooped £1m?Two lucky NS&I Premium Bond winners are now millionaires in the August draw. Find out here if you are one of them

By Tom Higgins Published

-

Savings rates more than double in a year as challenger banks top the best buy tables

Savings rates more than double in a year as challenger banks top the best buy tablesThe best savings rates have doubled - and in some cases tripled - in a year, with challenger banks offering the highest rates. While they are still no match for inflation, we look at what you could be earning.

By Ruth Emery Published

-

Midlife MOT: what is it and who can get one?

Midlife MOT: what is it and who can get one?The government has launched an online midlife MOT to help older workers with financial planning, health guidance and career skills. But how does it work, who can get one and would you pass it?

By Ruth Emery Published

-

Coventry Building Society launches new best easy access savings account

Coventry Building Society launches new best easy access savings accountCoventry Building Society's deal tops our easy access savings account list, but could your cash be put to better use?

By Tom Higgins Published

-

NS&I boosts fixed-term savings rates

NS&I boosts fixed-term savings ratesThe NS&I, the government-backed savings institution has mirrored recent rate rises seen elsewhere in the market.

By Tom Higgins Published

-

Should you let AI give you financial advice?

Should you let AI give you financial advice?Can AI fill the financial advice gap? Kalpana Fitzpatrick looks at the pros and cons of using AI to guide your finances.

By Kalpana Fitzpatrick Published

-

Small pension pots to be consolidated, says DWP

Small pension pots to be consolidated, says DWPWorkplace pension schemes worth less than £1,000 that become “deferred” when a saver changes jobs will be consolidated under a new system

By Ruth Emery Published

-

Watchdog summons banks to explain paltry savings rates

Watchdog summons banks to explain paltry savings ratesSavings rates trail mortgage rates - and the financial watchdog has summoned banks to a meeting amid concerns of profiteering.

By Katie Binns Last updated