Boom times for the collectable watch market

Vintage and collectable watches are setting records at auction. Chris Carter reports.

For all the troubles in financial markets, vintage watches continued to tick along nicely in June.

A rare Rolex wristwatch given to Royal Navy divers in the 1970s sold well above its high £120,000 pre-sale estimate with Bonhams in London to fetch £195,600, including buyer’s premium. The government-issued Rolex 5513/5517 Military Submariner, known as a MilSub, is a more rugged version of its civilian equivalent. Around 1,200 of the watches are thought to have been handed out during the decade, and many were damaged through years of use.

The example that sold is missing its bezel after the seller, the watch’s second owner, recalled it dropping off during a dive in the 1990s. But watches, being personal items, are somewhat special among collectables in that a bit of wear and tear usually adds to a watch’s appeal. Every watch has a story to tell – along with the time.

Subscribe to MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

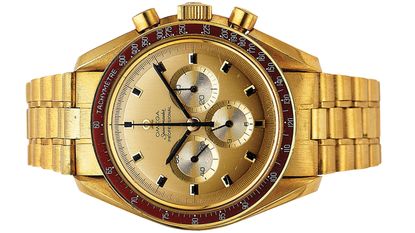

A giant leap for a wristwatch

Another wristwatch, a gold Omega Speedmaster No. 19 (pictured), that had been presented to astronaut Michael Collins in around 1969, also “soared light-years beyond pre-auction”, according to Texas-based Heritage Auctions. Collins was one of the three crew members on the inaugural moon landing that year, along with Neil Armstrong and Buzz Aldrin. Each of the astronauts, along with president Richard Nixon and his deputy Spiro Agnew, received one of the 28 timepieces made. It sold for $765,000, while the 210 lots in the sale brought in almost $3.4m combined.

Over in New York, auction house Phillips, in association with Bacs & Russo, “can’t stop setting watch auction records”, notes Carol Besler in the Robb Report. It brought in $30.3m in total at its latest watch sale, the second highest-ever amount for a US watch auction. It also concluded a highly successful “white glove” spring season (meaning every lot found a buyer) for Phillips’ watch department, which made $127.2m overall.

In the latest sale, five watches sold for over $1m, including the first platinum George Daniels Anniversary watch, with serial number 00. It sold for $2.4m – again, well above its $1m estimate, to set a record for a British wristwatch. Some of the proceeds went to good causes.

The collectable watch market is hitting new heights

Staying in New York, rival auction house Christie’s broke its own watch sales record, with its two-day event bringing in $21.8m in total. Almost 60% of lots sold above their high pre-sale estimates. The highlight of the sale series was “The Kairos Collection” of 128 “extraordinary” modern Patek Philippe timepieces, which together sold for a combined $21.9m in Geneva, Hong Kong and New York.

The stand-out item in the New York sale was a Patek Philippe Ref. 5531R-012, an “exceptional” 18-carat rose gold Grande Complication. It fetched a little over $2.2m.

Watches go digital with NFTs

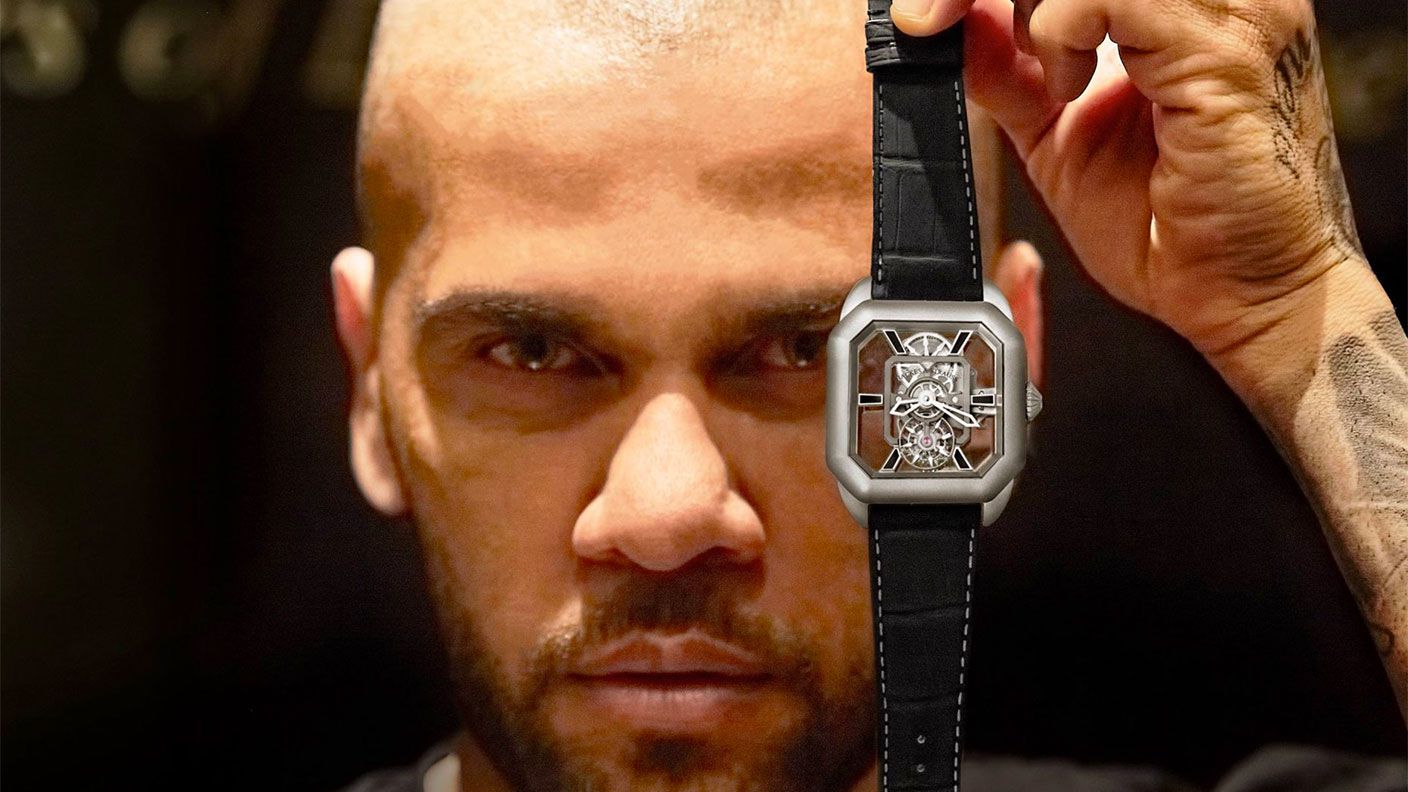

Watchmakers in search of new markets are embracing unique digital artworks, known as non-fungible tokens (NFT). In May, luxury British brand Backes & Strauss announced its collaboration with Brazil and FC Barcelona footballer Dani Alves (pictured) and specialist consultancy ColossalBit to produce a series of NFTs related to the 43 physical timepieces of the “Alves Trophy Collection”, celebrating the 43 trophies won by Alves in his two-decade-long career, says Jessica Bumpus in The New York Times.

In a similar vein, in April, Nima Behnoud, a former creative director of retailers Jacob & Co and Tourneau, launched a collection of 1,810 digital watch NFTs. Called Nimany Club, the collection is organised into various levels, along the lines of a video game, with the rarest priced at 0.1 ether (the cryptocurrency used on the digital ledger Ethereum), worth around $181, says Bumpus. These could be traded for Nimany-brand watches via a lottery draw.

Meanwhile, Swiss watchmaker Tag Heuer will give wearers of its Connected Calibre E4 smartwatch the ability to view their NFT artworks on the go, notes Laure Guilbault for Vogue Business. Users just need to connect their “smart wallet” (which holds their NFTs) to their smartwatch via an update from Apple’s App Store and Google’s Play Store.

“We think that the wrist is a great place to display your NFT – to have it close to you but also as a way of authentication between members of the community, like a badge of honour,” Tag Heuer’s CEO Frédéric Arnault tells Vogue Business. The LVMH-owned brand began accepting cryptocurrency payments in the US from May.

Chris Carter spent three glorious years reading English literature on the beautiful Welsh coast at Aberystwyth University. Graduating in 2005, he left for the University of York to specialise in Renaissance literature for his MA, before returning to his native Twickenham, in southwest London. He joined a Richmond-based recruitment company, where he worked with several clients, including the Queen’s bank, Coutts, as well as the super luxury, Dorchester-owned Coworth Park country house hotel, near Ascot in Berkshire.

Then, in 2011, Chris joined MoneyWeek. Initially working as part of the website production team, Chris soon rose to the lofty heights of wealth editor, overseeing MoneyWeek’s Spending It lifestyle section. Chris travels the globe in pursuit of his work, soaking up the local culture and sampling the very finest in cuisine, hotels and resorts for the magazine’s discerning readership. He also enjoys writing his fortnightly page on collectables, delving into the fascinating world of auctions and art, classic cars, coins, watches, wine and whisky investing.

You can follow Chris on Instagram.

-

-

Premium Bond alternatives to turn savings into winnings

Premium Bond alternatives to turn savings into winningsStill waiting on Agent Million to knock on your door? Consider these Premium Bond alternatives for your portfolio.

By Tom Higgins Published

-

Investment trust discounts hit 2008 levels. Here’s how to profit

Investment trust discounts hit 2008 levels. Here’s how to profitInvestment trust discounts have risen to levels not seen since 2008, here are three trusts looking to buy to profit.

By Rupert Hargreaves Published

-

Investing in wine: how Cru Wine is reaching new audiences

Investing in wine: how Cru Wine is reaching new audiencesTips Gregory Swartberg, founder of fine wine specialist Cru Wine, talks to Chris Carter about how to start a wine collection

By Chris Carter Published

-

Small companies with big potential

Small companies with big potentialMichael Taylor of Shifting Shares reviews his 2023 picks and highlights more promising minnows.

By Michael Taylor Published

-

The MoneyWeek portfolio of investment trusts – July 2023 update

The MoneyWeek portfolio of investment trusts – July 2023 updateTips A decade ago we set up the MoneyWeek portfolio of investment trusts. They remain a compelling long-term bet says Rupert Hargreaves

By Rupert Hargreaves Published

-

Women lead the way with ethical investments

Women lead the way with ethical investmentsDemand for more ethical investments has soared – and women are more likely to opt for them. Annabelle Williams, personal finance specialist at Nutmeg, takes a look at why.

By Annabelle Williams Published

-

BoE: Mortgage payments to rise by £220 a month for households

BoE: Mortgage payments to rise by £220 a month for householdsMillions of households can expect a mortgage spike of around £200 a month - and some may even reach a extra £1,000 a month, the Bank of England warns

By Marc Shoffman Published

-

What happened to Thames Water?

What happened to Thames Water?Thames Water, the UK’s biggest water company could go under due to mismanagement and debt. We look into how the company got itself into this position, and what investors should expect.

By Simon Wilson Last updated

-

Where to invest in the metals that will engineer the energy transition

Where to invest in the metals that will engineer the energy transitionA professional investor tells us where he’d put his money. This week: John Ciampaglia, manager of the Sprott Energy Transition Materials UCITS ETF.

By Nicole García Mérida Published

-

How investors can profit from high food prices

How investors can profit from high food pricesThe latest furore over grocery prices will die down, says David Stevenson. But the long-term outlook for soft commodities remains bullish. These are the stocks investors can buy to profit from high food prices.

By David J Stevenson Published